The financial model is the foundation for analyzing the future development of a business. With its help, you can assess risks, growth prospects, and the correctness of plans. To conduct an analysis of a financial model, it is necessary to understand which indicators are key and how to interpret them correctly.

ROI – an important indicator for any financial business model

ROI (Return on Investment) is one of the most well-known and widely used parameters. It helps determine how profitable the invested capital has been. The value not only reflects the efficiency of investments but also helps investors and managers understand whether their expenses will pay off.

This indicator allows you to quickly understand how effective a particular financial model is. If the ROI is above 10%, it may signal that the business is heading in the right direction. However, it is important to remember that normal values of this parameter can vary significantly for different sectors of the economy.

Why ROI is important:

- Easy to understand: usually, a simple ROI calculation is sufficient to evaluate business or project efficiency indicators.

- Comparison of alternatives: by calculating ROI for several investment options, you can choose the most profitable one.

- Risk assessment: investors can assess the risk of investing in a particular project.

Indicators of a financial model based on ROI allow for making quick and informed decisions for further steps.

NPV: how to calculate Net Present Value?

NPV (Net Present Value) is a parameter often used to determine the profitability of investments. It measures the difference between the present value of future cash flows and initial investments. NPV takes into account the time value of money, making it much more accurate and informative than just ROI.

How is NPV calculated?

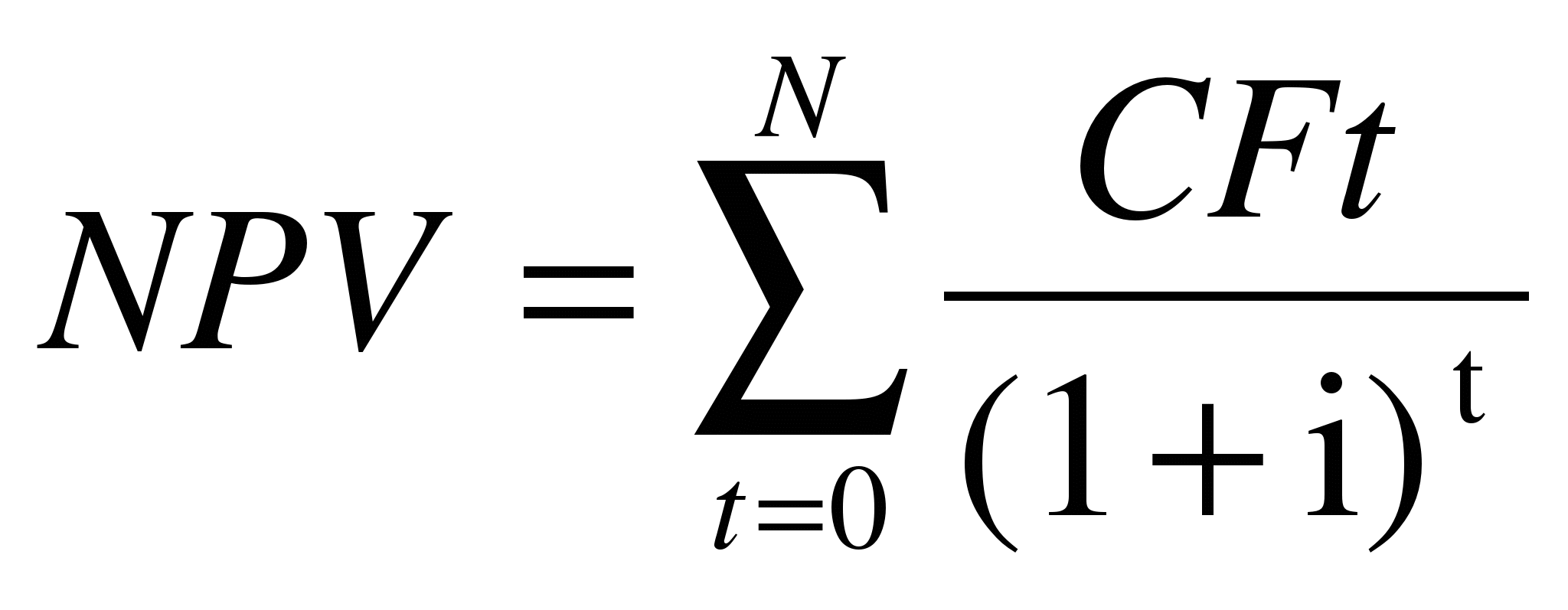

The following formula is used for calculation:

where:

- N: number of planning intervals;

- CFt: cash flow for period t;

- i: discount rate.

Calculation example: if a project involves annual cash flows of 100,000 rubles for 5 years, the discount rate is 10%, and the initial investments amount to 400,000 rubles, NPV can be calculated.

Using the formula, you can determine whether it is worth investing in a project considering the time value of money. If NPV is positive, the investment is considered profitable. This means it will generate profit. If the parameter is negative, the project will not be profitable.

IRR: Internal Rate of Return

IRR (Internal Rate of Return) is the percentage at which the project’s NPV is zero. This financial model indicator allows you to assess how profitable a project can be compared to other investments.

To calculate IRR, iterations are required to find the discount rate at which NPV becomes zero. The parameter can be considered as the “effective rate” for the project.

Example of calculating IRR

Let’s assume a project requires investments of 1,000,000 rubles and generates annual income of 300,000 rubles for 5 years. To calculate IRR, several iterations are needed to find the discount rate at which NPV equals zero. For example, if IRR is 12%, it means the project can generate a profit of 12% annually, which is quite attractive for most investors.

Payback Period: how quickly to recover invested funds?

The payback period is the time it takes for the initial investments to be recovered by the company through generated profits. This is an important indicator of the financial model for assessing risks and planning business liquidity.

To calculate the payback period, simply divide the initial investments by the annual cash flow. For example, if a project requires investments of 500,000 rubles and generates annual profit of 100,000 rubles, the payback period will be: 500000÷100000=5 years.

This means the project will pay off in 5 years. The parameter is important for investors who want to recover their funds as quickly as possible, especially in uncertain conditions.

Profitability and Liquidity Ratios: Basics of Financial Model Analysis for Company Evaluation

In addition to the main indicators, ROI, NPV, and IRR, it is important to use other metrics — profitability and liquidity ratios for analyzing the financial model. They allow you to assess the company’s ability to generate profit and promptly settle debts.

Profitability Ratios

These parameters measure the profitability of the business. Among the most popular are:

- Return on Assets (ROA): shows how much profit the company generates per each ruble of assets.

- Return on Equity (ROE): indicates how efficiently the company’s equity is used to generate profit.

These values help investors understand how effectively the organization utilizes its resources.

Liquidity Ratios

These parameters are necessary to assess the company’s ability to quickly settle its obligations. Among them are:

- Current Ratio: the ratio of current assets to current liabilities.

- Quick Ratio: a similar indicator, but without inventory, making it more stringent.

This knowledge helps understand how quickly the company can overcome financial difficulties.

Conclusion

Each business and project have their own characteristics, and choosing the right indicators of the financial model will help determine how profitable and promising the chosen path is. It is important to remember that no parameter works on its own. It should be analyzed in the context of other metrics and taking into account current market conditions.

Financial model indicators not only help forecast results but also make informed strategic decisions. It is important for every investor and businessman to know how to correctly calculate and interpret these metrics to minimize risks and achieve high financial results.

en

en  ru

ru  de

de  ar

ar  es

es  hi

hi  fr

fr  nl

nl  it

it  pt

pt  el

el